Unpacking Canada's Greenwashing Problem

With industry actors being hesitant in transitioning towards net-zero business practices, the Canadian Government must institute enforcement mechanisms to hold big corporations and banks accountable.

By Harshini Ramesh

RISING EMISSIONS, A WARMING PLANET and mounting social pressure have pushed global leaders to be more prudent in getting countries toward a net-zero future. Non-state actors like companies, cities, and banks play a critical role in moving countries toward this goal. Unfortunately, instead of creating credible, science-based climate plans, private actors are choosing to practice greenwashing. At COP27, former environment minister Catherine McKenna unveiled a key report outlining how non-state actors, especially private actors, can create and attain net-zero targets. The Canadian government needs to ensure that private actors, who are largely responsible for greenwashing in Canada, are held accountable for creating and meeting environmental targets.

The Carbon under the Green

Green products have become increasingly popularized by consumers looking to live more sustainable lifestyles. According to the Harvard Business Review, frequent-use products that were labeled as sustainable, witnessed a 50 percent growth. To capture this demand, companies have increasingly started to put out green or sustainable products. But creating greener products is expensive; it requires companies to overhaul the very processes and supply chains that cut down costs, with innovations that still do not exist.

Instead, companies have started engaging in greenwashing. Greenwashing is a marketing practice leading consumers to believe products are greener than they are. While there is no singular definition, generally, green products are defined as ones that minimize environmental impact in their product life cycle. Advertising confuses consumers by using tactics such as misleading graphics, language describing sustainability, and claims of receiving “green” awards, among others.

Canadian private actors are advertising their actions as green, despite pouring billions into carbon-intensive projects. RBC, Scotiabank, TD, BMO and CIBC have increased their financing of fossil fuel projects each year since 2020. Banks have yet to make robust net-zero targets or emissions reduction policies. In January 2022, the Competition Bureau concluded that Keurig Canada’s claim of recyclable single-use coffee pods was misleading and not widely accepted in municipal recycling programs.

Institutional gaps enable private actors to practice greenwashing. The Glasgow Financial Alliance for Net Zero (GFANZ) is a global coalition of banks committed to investing in and creating policies for a net-zero economy by 2050. GFANZ updated its criteria this year to feature a fine print, enabling banks to continue investing in carbon-intensive projects until 2023. The report provides recommendations and guidance for net-zero actions, but banks are left to set targets with little oversight. This year, the Canadian Securities Administrator discovered that environmental, social, and governance (ESG) investments made by over half of the reviewed investment fund portfolios lacked details about disclosures and investment strategies related to ESG claims. To date, there are no specific laws to regulate green advertising.

The Impact of Greenwashing on Canadians

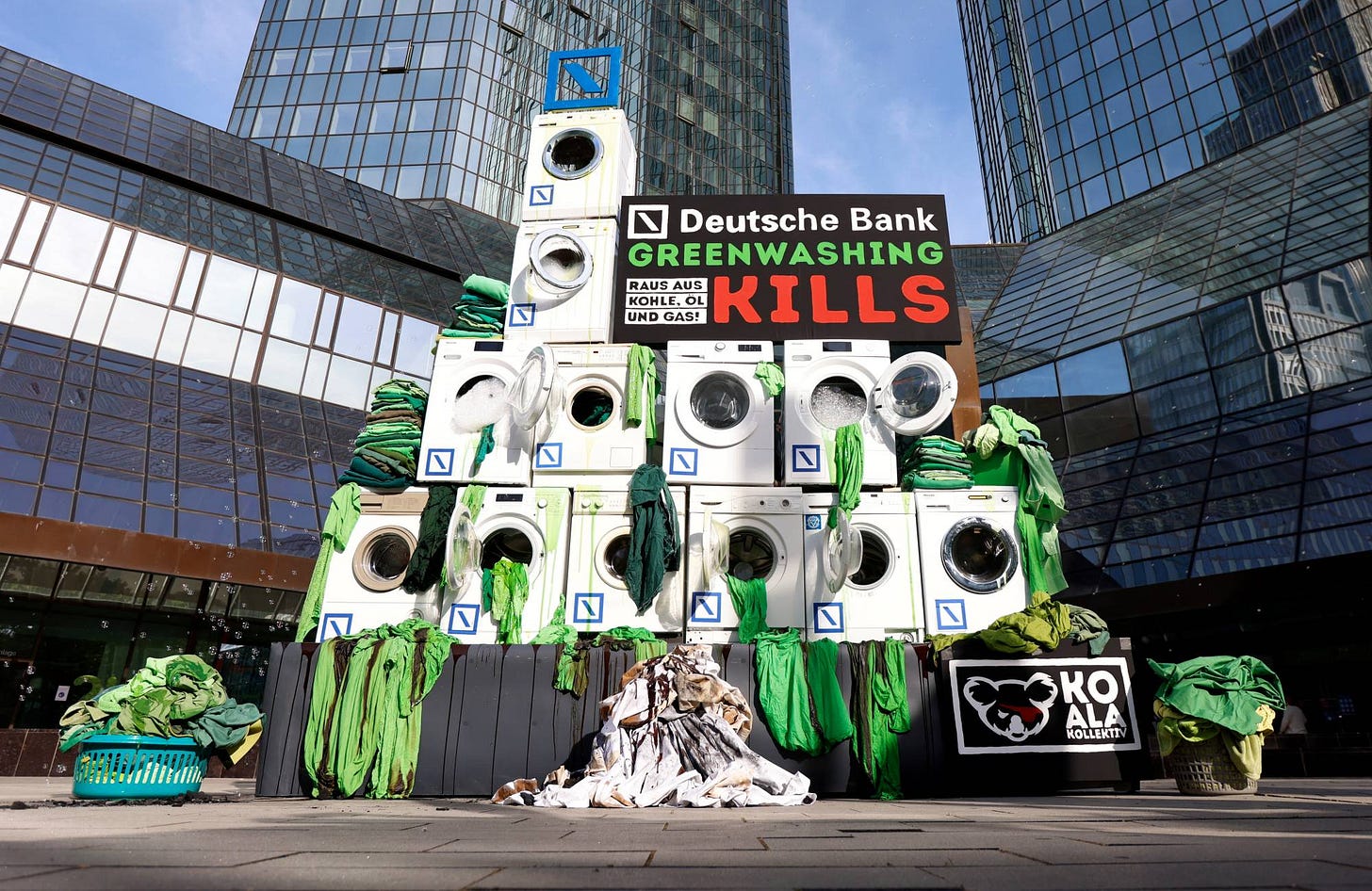

Consumers are making investment decisions with inaccurate information. The Deutsche Bank is being sued for using green credential materials on a fund’s marketing materials. Their fund was advertised to investors as investing “0 percent in controversial sectors such as coal” while its marketing materials stated that 15 percent of revenue came from that industry. H&M on the other hand, has recently come under scrutiny for either claiming that their products were more sustainable than they were or were found to be giving false information altogether. Briefly, H&M misled consumers with scorecards which did not represent the full environmental impact of manufacturing and selling an article of clothing, potentially downplaying some environmental harms.

Greenwashing also leads many customers into believing that private entities are pursuing a social good when they do the opposite. RBC advertises corporate commitments to clean energy development, in partnership with Indigenous communities, towards a net zero future. These plans are now under scrutiny after the Skat’sin te Secwepemc-Neskonlith Indian Band filed a complaint with the Competition Bureau. The complaint aims to tackle RBC’s claims of aligning with the Paris Agreement’s principles and their commitment to sustainable financing, while simultaneously funding companies or projects that increase greenhouse gas emissions.

Greenwashing can allow harmful activities to continue, in turn creating unsafe environments for Canadians. A group of concerned health professionals have filed a complaint against the Canadian Gas Association for misleading or false representations of natural gas and gas appliances, which create indoor pollution and subsequent health risks. Hurricane Fiona has devastated Atlantic communities, leaving residents without a home and power for weeks. Insured damages are a record-breaking $ 660 million, making it the costliest extreme weather event in Atlantic Canada’s history. The federal government’s “Canada’s Changing Climate” report states that greenhouse gas (GHG) emissions from GHG-intensive projects are linked with increasing tropical storm intensity on Canada’s Atlantic coast. The effects of climate change will only increase in severity and magnitude.

Cracking down on Greenwashing

The Canadian government needs to create accountability and enforcement mechanisms to ensure private actors are disincentivized from greenwashing.

While Canadian banks are members of GFANZ, voluntary commitments without enforcement mechanisms provide little incentive to change current patterns of funding. The Superintendent of Financial Institutions, Canada’s banking regulator, is working on accountability by putting together climate-reporting guidelines for banks. This will require climate-related financial disclosures starting in 2024. To access finances and financial services, banks and other financial institutions will need to make climate-related disclosures about climate risks and emissions. To enforce these disclosures, the government should begin to take punitive action against misleading claims. The US Securities and Exchange Commission has begun fining banks for falsely implying that mutual funds met ESG quality reviews. Similar reviews and regulatory interventions can discourage greenwashing behavior in Canada.

Canada has begun creating mandatory disclosure guidelines for insurance companies. The same action should be expanded to other private companies. The European Union (EU) has created the Corporate Sustainability Reporting Directive which will soon become law. EU companies will need to meet certain thresholds for ESG standards and participate in reporting. Similar mechanisms can hold companies accountable to their promises and catalyze action to create more robust net-zero plans.

As the world inches closer to 1.5 degrees, everyone has a responsibility to work toward net-zero. Private entities have fallen short of delivering on their promise of exhibiting an honest effort toward encouraging sustainability. Without government regulation, Canadians will bear the brunt of greenwashing through misguided investments and damages to their environment, health, and communities. Federal regulation will play a critical role in the next few years and must hold companies and banks accountable.

Harshini Ramesh is a Masters of Public Policy Candidate at the Max Bell School for Public Policy at McGill University. She is interested in climate and environmental policy, as well as advancing innovative solutions that reimagine policy and governance responses to climate change.

Excellent article